I have zero credit. As in none. Ever. Never had a house payment or car payment. I’ve never needed to finance anything. As a child, my parents taught me the value of money. My father told me to only spend what you have. With credit, you may have a $5,000 line of credit. That doesn’t mean you have $5,000 in your bank account. Even if you do have $5,000 in your account, you’re using that money for rent and other bills. Credit cards become confusing fast. For that reason alone, I’ve never had credit.

In April of 2017, Jill and I found out we’re having our first born child. We wanted to get a new car. I figured no credit is better than bad credit. Kind of makes sense right? If I never had credit, and I start off with a car, I’d build credit quickly. What a learning curve. That’s not how credit works and lenders won’t touch you.

I’m what you call a ghost. No database on earth has any form of credit attached to my name. The guy at the Volkswagon dealership shook my hand. He’s never met a credit ghost.

So I decided to do something about it.

Build credit with secured cards

You know, I didn’t honestly know where to start. I decided I needed to check my credit score. That’s not actually easy to do. You do get a free annual report. That works for most people. It didn’t work for me because I can’t remember all of the phone numbers I’ve had in the past 7 years. The numbers I can remember do not appear on the form to validate your information.

Then I created a login to Credit Karma. I had a little better success with their service. By the way, it’s true when they say you do not need a debit card in order to use their service. The best part of checking Credit Karma is seeing your score calculate. Except when you’re me. My credit score was a 4. Not 400. A plain 4.

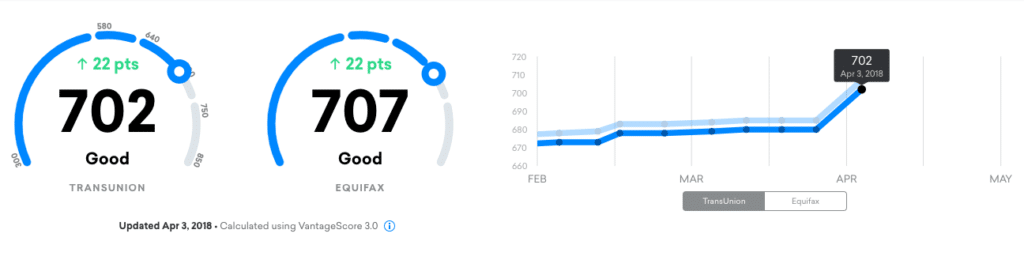

You can see the image above, I had a credit score of a 524 in May of 2017. The number dips below the line and disappears.

Credit Karma is where I first discovered secured credit cards. A secured card is where you pay an amount of $200 as a deposit. Once approved your deposit is your line of credit. The irony here is having your credit checked when you apply for a secured card.

Credit Karma presented me with the Capital One Platinum Secured Card. I filled out the form and I was approved. With Capital One, your credit will determine if you pay $49, $99 or $200. Your credit line will be $200 either way. However, the better your credit the less you have to put down as a deposit.

Some credit cards are better than others

The Capital One Secured Card is purely for building credit. After a couple Google searches, I discovered the Discover It Secured Card. It’s the same card as the Capital One. However, the Discover It card has some perks such as cash back rewards and online reward deals with other companies. I personally think the Discover It secured card is the best way to go when building credit.

I do recommend having two secured cards to build your credit. The reason comes down to payment history and credit age. Your credit age is the average age of your cards. So if you have three cards that are 10 years old and one card that is one year old, the math would be (10+10+10+1)/4 = 7.75. Your credit age is 7.75 years old. So starting off with many cards early can help you with your credit age down the road.

Here’s the payoff

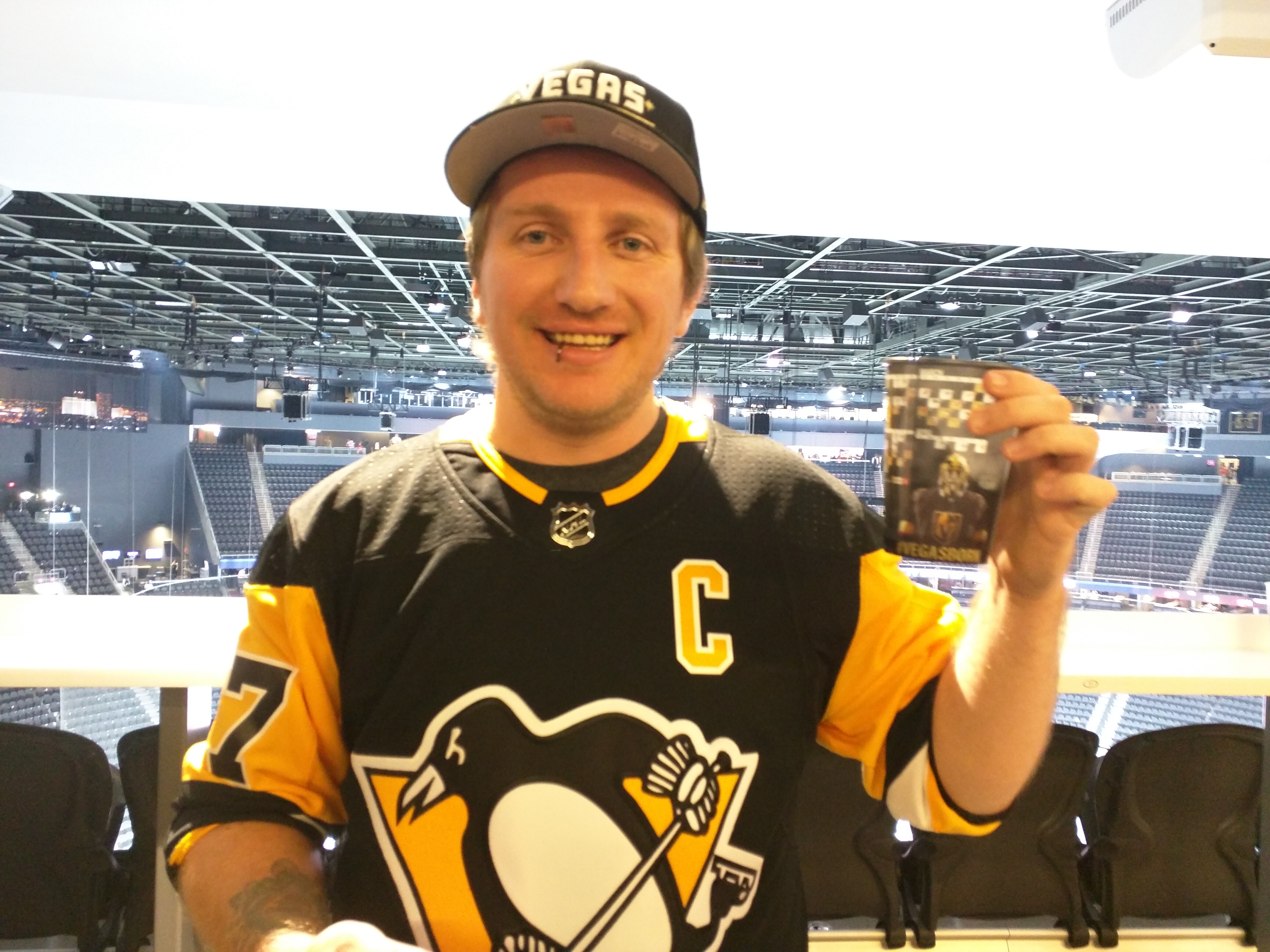

My good buddy John Hawkins reached out to me a while back. He has Vegas Golden Knights season hockey tickets. He wanted to know if I was interested in purchasing a few of the games to offset some of the cost. I was 200% willing and had my money ready. Once my Discover It card came in the mail, there was an advertisement in the envelope stating “Get Cashback when using your Discover It card at NHL games across the country”.

Yeah. Because Discover is the official card of the NHL. You also get cash back and rewards if you shop with your Discover It Card on the NHL store.

Here’s the kicker. Jill and I both have the Capital One and Discover cards. She bought me the Penguins Jersey I’m wearing in my photo. You get cash back, a discount and building credit? Score.

So now that I have Vegas Golden Knights tickets and a Discover It card, I’m going to build my credit one beer at a time at each home game! You should too!

The credit trap is one of the easiest to fall into? I have not had a credit card for ten years. Do use a CU debit card online and in stores. We were debt free in 2000. By 2005 we were again 50,000 in debt. Sold a property, paid off all plastic and simply stopped using credit imagination money. The rule of thumb is that anything you purchase with plastic will cost you double. Building up a credit profile is great when you go to buy a house or car. The minute you find that you are not paying off your cards at the end of the month, then it is time to bail. It’s a wicked trap. Read “Web of Debt” by Ellen Brown. https://www.lisamharrison.com/pdf/Web%20of%20Debt%20By%20Ellen%20Hodgson%20Brown.pdf

I 200% agree. We’re trying to buy a new car and house. Once I get those, I’ll go back down to one card and have a very limited use. Thank you for the advice.